Insurance for businesses in France is a legal obligation in several business sectors so if you’re opening a company in France you need to make sure you are properly insured to cover yourself in any eventuality – life has a habit of throwing curveballs and leaving yourself unprotected can mean you also leave yourself open to lawsuits and prosecution.

Laura Scemama from the French insurance broker Assurla gave some examples of when insurance is needed: “If a socket catches fire or if there’s flooding following a poorly closed window and the offices are impossible to use, multi-risk insurance covers business premises and will cover the restoration of the premises, and an operating loss insurance will collect the earnings that have been lost during the period of non-use. Or for instance if you sell a product that provokes an allergic reaction in one of your customers who sues you for damages - your liability insurance will compensate the customer if necessary; or if a person physically falls on your premises and hurts themselves or breaks a limb, your liability insurance will compensate them for the damage suffered.”

Whether it's a small family business or a large corporation, subscribing to appropriate insurance is crucial to deal with risks and ensure the longevity of the company. So to help you navigate the system, here’s the main types of business insurance available in France for entrepreneurs and business owners.

Professional liability insurance:

Professional liability insurance is essential for any business in France. It is mandatory and put in place in order to cover all damage that may be caused to a customer, a supplier or a third party in the context of a professional sales or service activity.

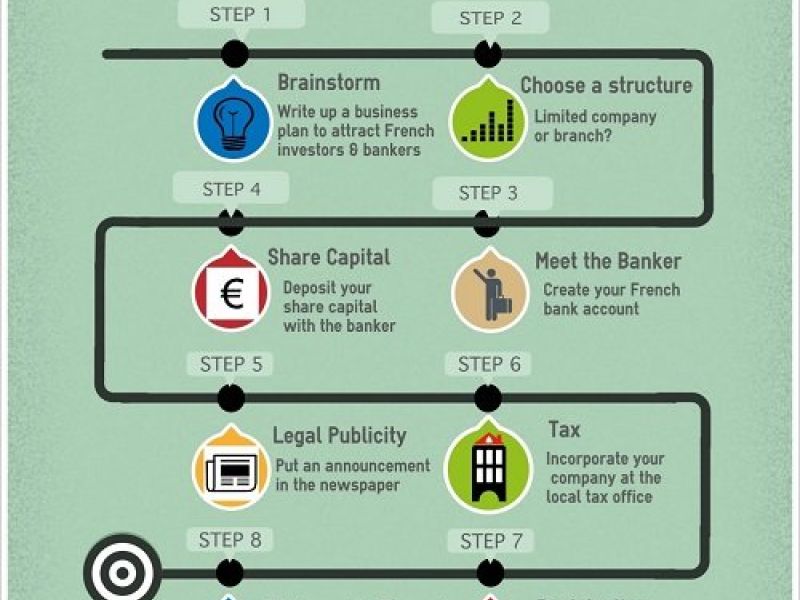

Related article: How to start a business in France in 8 Steps

This may be damage: bodily (such as injury to a customer), material (breakage or destruction of property belonging to a customer), or immaterial (for example, loss of turnover from a customer).

Professional multi-risk insurance:

Multi-risk professional insurance is a complete solution that combines several guarantees in a single insurance policy. It generally covers real estate, equipment, inventory, as well as operating losses in the event of a disaster. This insurance offers comprehensive protection against risks related to property damage, such as fire, natural disasters and theft.

Corporate health supplement:

Company mutual insurance is a contract for collective health costs. The ANI law makes company mutual insurance (or so-called complementary health insurance) mandatory for all executive and non-executive employees. All company employees must be covered. Private sector employers are obliged to offer collective mutual insurance to their employees.

Ten-year civil liability: (building activity only)

The ten-year civil liability guarantee is compulsory as soon as construction, extension and/or renovation work is undertaken on the structure of the building.

Vehicle fleet insurance:

For companies that own various vehicles as part of their business such as deliveries or servicing, vehicle fleet insurance is compulsory.

Related article: How to pay tax in France for expats and entrepreneurs

This insurance covers material damage and bodily injury caused by company vehicles, as well as theft and fire. By purchasing vehicle fleet insurance, contractors can protect their assets and ensure business continuity in the event of an accident.

Legal protection insurance:

The legal protection guarantee covers the costs of proceedings in the event of a dispute between an insured and a third party in the context of: the defense of the insured in the dispute of professional life, a future procedure, or compensation for court costs.

Cyber risk insurance:

In the digital age, businesses are increasingly exposed to cyber risks such as cyber attacks, data theft and extortion. Cyber risk insurance provides protection against these threats by covering the costs of data breach notification, data recovery, legal fees, and financial loss related to a cyber attack.

Protecting corporate data and sensitive information is a priority for most businesses these days, but especially those in the health sector that processes sensitive information.

Key Person Insurance:

The key person is an entrepreneur or an employee who is essential to the proper functioning of a company. His inability to carry out his work on a temporary or permanent basis may lead to a drop in turnover or even a cessation of activity for the company. Key person insurance aims to compensate for a company's operating loss to guarantee its sustainability. It also offers attractive tax advantages.

Manager's Health Mutual:

Covers the manager's health costs in addition to social security.

Foresight Insurance:

Provides protection against certain uncertainties of life: death, work stoppage and disability. Highly recommended for the manager of companies who do not benefit from any Social Security coverage. It is important to take into account the risks associated with the ups and downs life can bring and to cover yourself accordingly.

Related article: How to I pay VAT/TVA in France?

While no one is ever fully safe from fault or negligence and the risks vary from one profession to another but we hope this guide gives you some idea of what insurance you’ll need as a business owner to protect yourself as best you can. For more information on how to set up a company in France, take a look at our free downloadable guide below.