If you're thinking of owning a business in France and are planning to employ people to work for you, then you will need to hire someone who knows how the payroll system works in France.

Many business owners choose to outsource their payroll department because the system can be very complex and is subject to constant changes in legislation. (New laws are currently being passed that will completely change the way French people pay income tax - instead of filing their tax earnings individually each year, it will soon to be taken automatically out of their paypackets each month).

A French ‘expert comptable’ – a chartered accountant who is legally obliged to keep up to date with changes in tax and employee law – is your first port of call if you want to make sure your payroll system is well managed and legally organised within the French system.

An accountant will keep in close contact with the social security authority URSSAFF (Unions de Recouvrement des Cotisations de Sécurité Sociale et d'Allocations Familiales) to file declarations for you and update your employment register.

An expert can also organise the two types of contracts open to an employer - a “contrat à durée déterminée” (fixed term contract for say three to six months) or a “contrat à durée indéterminée” (indefinite term contract).

The laws can be very tricky and intricate in France when it comes to employee rights (especially if the employee is on an indefinite term contract) so you need to cover yourself by hiring an excellent accountant who can navigate this system easily for you.

As well as producing the payslips, an expert comptable will also help with organising pension funds and insurance as well as acting in any matters requiring HR expertise (in the case of having to fire an employee or in cases of redundancy).

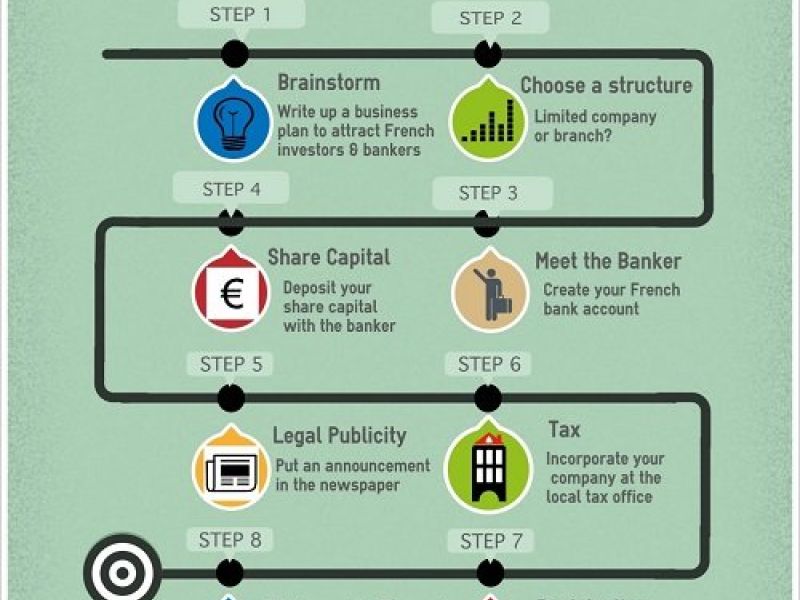

If you’re interested in speaking with an expert who can help you organise your payroll, then call us on 0033 (0) 1 53 57 49 10 or email us through our contact page and we’ll be happy to help. Or click here for more information on English-speaking chartered accounts in France. We also have a free downloadable guide below on how to open a company in France with all the details you'll need to know.