In the post-Brexit clamour to tempt businesses away from Britain, the best claimant may be France. The UK’s closest continental neighbour already has thriving hubs for many of the UK’s key industries. With the banking sector a particularly tempting prize, politicians have already rallied to provide further incentives. So what are the prospective benefits for potential defectors, and how complicated is the process of forming a business in France?

The swiftest and loudest appeal was from Paris to the City of London, primarily courting its financial institutions. With Paris already home to £3.1 trillion of assets under management, the French markets are well established. And in the run-up to elections, the French government is keen to distance itself from Hollande’s early policies.

Adverts welcoming British businesses went online immediately after the vote, and more than 4000 letters were sent to city investors. The French government has also worked feverishly to push through an extension to expat tax exemptions, offering eight years of incentives for workers based in France.

Business incentives for relocating to France

As of September 2016, individuals sent to work in France by a foreign company or recruited to work in France by a French company are tax exempt on any perks or supplements to your salary, or from 30% of the net remuneration. There is also a 50% exemption on any shares, deposits and capital gains tax, providing the payments originated from a foreign source.

While squarely aimed at attracting bankers, this could also apply to smaller businesses and entrepreneurs with the right structuring. As with any tax scheme, it's vital that you seek professional advice before attempting to take advantage.

Smaller businesses could also reap more tangible benefits from hopping the Channel. Another recent tax break allows corporations investing in SMEs to spread the expense over five years. This is beneficial in minimising tax and maximise profits, helping both investor and recipient. Efforts will also be made to help families integrate, with schools across the country promising foreign language classes for new students.

What do you need to do?

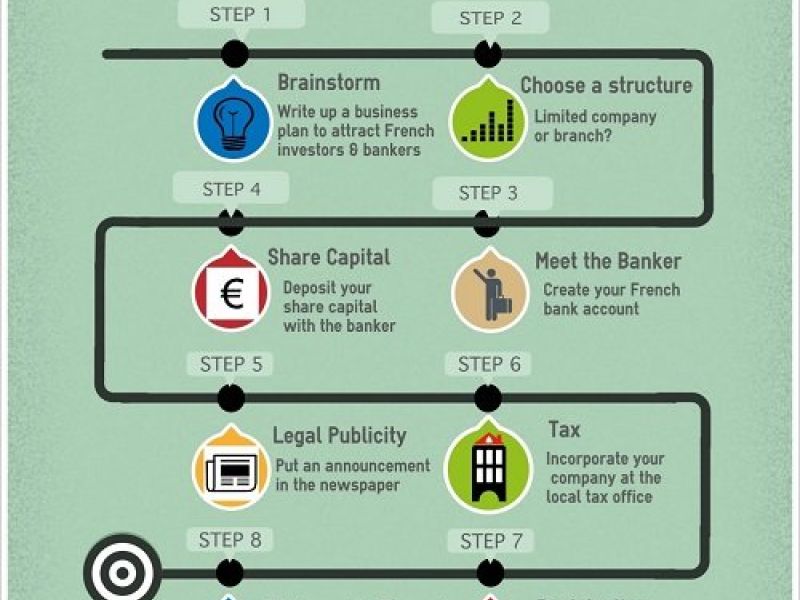

Once you’ve decided to up sticks and move, the first big decision is picking the right business structure for your needs. The variations are numerous, and while it is possible to change, you’ll want to get it right first time.

The difference between a EURL and a SARL for instance might not be immediately apparent. As changing business classifications can be difficult, it is vital to seek specialist advice for any company formation.

Most small businesses in France will choose to incorporate as a SARL, a form of limited company. SARLs have a minimum of one director and technically requires €1 of share capital, but banks will ask for a bare minimum of €4000 to open an account.

Partnerships with foreign companies will usually form as an SAS company, and larger businesses with a number of shareholders will usually become an SA, or corporation.

Fees and finances

Opening a bank account can be one of the more difficult parts of the process as regulations have tightened since 9/11. In most cases you will need a partner who speaks French to liaise with the various organisations.

Knowing exactly what you’re selling is a major part of company formation in France. After you’ve chosen your structure, you need to register your company’s by-laws through a company formation agent or lawyer. In essence, this will tie you to selling only the products or services mentioned therein.

The incorporation process requires a few administrative fees, as well as declaring the specifics of your business. This is accomplished by contacting the local ‘centres de formalités des entreprises’ (CFE) specific to your industry. They can then forward your application to the correct Chamber of Commerce in order to secure the requisite paperwork.

For more information on relocating to France, you can download our free guide below - we can help you with everything from accounting to serviced offices, bank accounts to registered addresses, tax planning to VAT services. You can call our team on 0033 (0) 1 53 57 49 10 or email us via our contact page with any queries you may have.